working capital turnover ratio formula class 12

If a company has a higher level of working capital it shows that the working capital of the business is utilized properly and on the other hand a low working capital suggests that business has too many debtors and the inventory is unused. Working Capital Turnover Ratio 6 Times Working Capital Turnover Ratio of six times shows that sales in 6 times that of employed assets of working capital should be compared to the previous years data as well as other players in the industry to get a better sense.

Capital Turnover Definition Formula Calculation

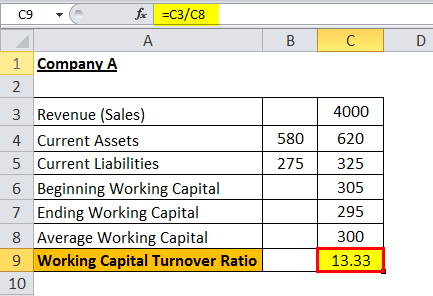

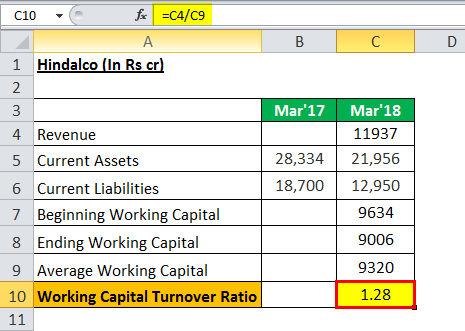

The formula for calculating working capital turnover ratio is.

. Take the Next Step to Invest. The working capital turnover ratio is thus 12000000 2000000 60. What this means is that Walmart was able to generate Revenue in spite of having negative working capital.

Net Credit Sales 18 00000. Meaning of Working Capital Turnover Ratio. This is reflected in a higher inventory turnover ratio.

1Fixed Capital The amount of capital investment in fixed assets is called fixed capital eg. Therefore Average Inventory 155000 245000 2 150000. Working Capital Turnover Ratio.

Working capital turnover ratio 5 Times Working note 1. Working capital Turnover ratio Net salesWorking capitalNet sales Total sales - sales return 130000 380000 10000 500000Working capital Current assets - current liabilities 140000 90000 - 105000 125000Working capital turnover ratio 500000125000 4 times. Inventory turnover ratio Cost of goods sold Average inventory.

This is reflected in a higher inventory turnover ratio. The formula for calculating working capital turnover ratio is. Working Capital Turnover Ratio Formula.

Working capital Current assets - Current liabilities Working capital 550000 - 180000. It shows the number of times a unit of Rupee invested in working capital produces sales. Working Capital Turnover Net Annual Sales Average Working Capital What Working Capital Turnover say to you The ratio of working capital turnover is determined by dividing net annual sales for the same 12-month period by the average sum of working capital current assets minus current liabilities.

Working capital turnover ratio Sale or Costs of Goods Sold Working Capital. NCERT Solutions for Class 12 Commerce Accountancy Chapter 5 Accounting Ratios are provided. In this formula the working capital is calculated by subtracting a companys current liabilities from its current assets.

Working capital turnover ratiocost of revenue from operations or revenue from operations i. Working Capital Turnover Ratio 15000 2500. The questions and answers of how is provision for doubtful debt a part of current liability in inventory turnover ratio and working capital turnover ratio are solved by group of students and teacher of class 12 which is also the largest student community of class 12.

NCERT Solutions for Class 12 Commerce Accountancy Chapter 5 Accounting Ratios are provided. Working Capital Turnover Ratio 1. Net sales Beginning working capital Ending working capital 2 Example of the Working Capital.

Similarly a better debtors turnover ratio may be. It reflects relationship between revenue from operations and net assets capital employed in the business. Financial Management Important Questions for CBSE Class 12 Fixed Capital and Working Capital.

The formula for calculating this ratio is by dividing the sales of the company by the working capital of the. 700000 Working Capital Turnover Ratio 56 times So the Working Capital Turnover Ratio is 56 times. Plant and machinery land and building etc.

As clearly evident Walmart has a negative Working capital turnover ratio of -299 times. Read below DK Goel Solutions for Class 12 Chapter 5 Accounting RatiosThese solutions have been designed based on the latest Class 12 DK Goel Accountancy book used by commerce stream students issued for the current year and the questions given in each chapter. Working capital turnover ratio 1850000370000.

The working capital of a company is the difference between the current assets and current liabilities of a company. And Average Inventory Beginning inventory Ending inventory 2. Net Working Capital and Revenue from Operations ie Net Sales.

It is a relationship between working capital and revenue from operations. Working capital turnover ratio Net Sales Average working capital 514405 -17219 -299x. We now look at the meaning and characteristics of working capital turnover ratio as mentioned in the chapter on accounting ratios class 12.

Accounting Ratios CBSE Notes for Class 12 Accountancy Topic 1. The formula for calculating working capital turnover ratio is. Revenue from the operation for the year were RS.

Calculate the inventory turnover ratio. Inventory Turnover Ratio 500000 150000 333. Current Ratio 3 1 Workings.

Working capital turnover Net annual sales Working capital. It establishes the relationship between. Working capital turnover Net annual sales Working capital.

This means that every dollar of working capital produces 6 in revenue. This means that the inventory turns over 333 times in a year for. When ratios are calculated on.

Working Capital Turnover Ratio. Working capital turnover ratio Sale or Costs of Goods Sold Working Capital. Net Working Capital Current Assets excluding Fictitious assets Current liabilities.

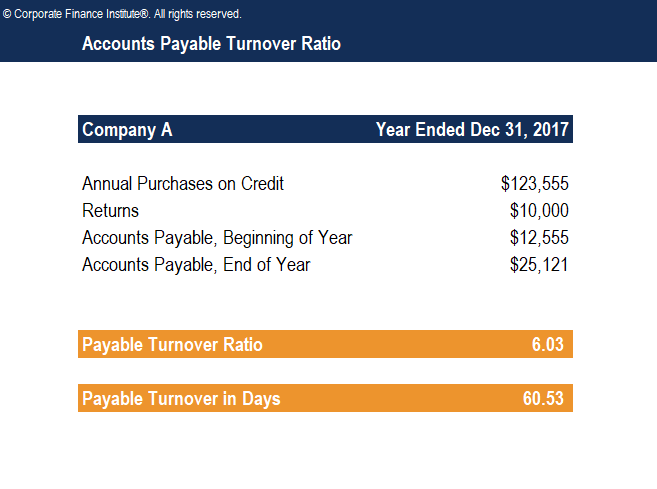

Capital Turnover Ratio 500000 40000 125 Interpretation It means each of capital investment has contributed 125 towards the companys sales and this 125 seems that the utilization of capital investment is done efficiently by the company. Trade Payable Turnover Ratio Purchases Average Trade Payables Purchases Creditors Bills payable 420000 90000 52000 420000 142000 296 times d Working Capital Turnover Ratio. Working capital turnover ratio interpretation.

From the following information calculate the working capital turnover ratio. Ratio It is an arithmetical expression of relationship between two related or interdependent items. It signifies that how well a company is generating its sales with respect to the working capital of the company.

700000 Working Capital Turnover Ratio 56 times So the Working Capital Turnover Ratio is 56 times. Working Capital turnover ratio Accounting Ratio Activity ratio class 12 Accounts video 110class 12 Accountsaccounting ratiosworking capital turnover. Accounting Ratios It is a mathematical expression that shows the relationship between various items or groups of items shown in financial statements.

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

Working Capital Turnover Ratio Formula And Calculator

Calculate Trade Payables Turnover Ratio For The Year 2018 19 In Each Of The Altern Youtube

4 Inventory Turnover Ratio With 5 Practical Problems How To Calculate Stock Turnover Ratio Youtube

Inventory Turnover Ratio In Retail How To Calculate And Improve It Dor

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Formula Calculator Excel Template

Accounts Payable Turnover Ratio Formula Example Interpretation

Activity Ratio Formula And Turnover Efficiency Metrics

Working Capital Turnover Ratio Meaning Formula Calculation

Activity Ratio Formula And Turnover Efficiency Metrics

How To Calculate Key Financial Formulas

How To Calculate Working Capital Turnover Ratio Flow Capital

Working Capital Turnover Ratio Meaning Formula Calculation

What Are Activity Ratios Formulas And Examples Tutor S Tips

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Class 12 Accountancy Accounting Ratio Youtube